-

-

TYPE OF WORK

Full Time

-

-

SALARY

$10 to $15

-

-

HOURS PER WEEK

40

-

-

DATE POSTED

Nov 22, 2024

Are you looking for an exciting career opportunity with competitive pay and room for growth? Join a dynamic team where your contributions matter, and you can develop your tax expertise while working with top-tier clients!

Job Code: TXPKS

Benefits of Joining Us:

- Competitive pay ($10 to $15 per hour, based on experience).

- Consistent, steady pay… ON TIME, every time.

- Prepaid Healthcare card (up to $1,000+).

- 13th-month bonus, paid quarterly.

- Opportunities to grow within the company.

- Holidays off and ownership mentality.

- Be part of an amazing, supportive PH community.

Key Requirements:

- Minimum of 2-3 years of experience in U.S. tax preparation; familiarity with IRS forms and requirements is necessary.

- A bachelor's degree is preferred but not strictly required

- Ability to manage multiple client engagements and tasks efficiently

- Strong analytical and project management skills

- Experience: Prior experience in public accounting, an agency, or a CPA firm is preferred.

- Attention to Detail: Proven ability to organize documents accurately, label files appropriately, and identify client errors.

- Client-Facing Communication: Excellent written and verbal communication skills, comfortable with direct client outreach.

- Technical Skills: Proficient in Microsoft Office Suite, and Adobe Acrobat, and experience with tax filing software is a plus.

- Relevant certifications or degrees in accounting, finance, or business are an advantage.

Main Responsibilities:

- Prepare and file federal, state, and local tax returns for individuals and businesses.

- Ensure all tax returns comply with applicable laws and regulations.

- Meet with clients to gather necessary financial information.

- Advise clients on tax planning strategies to minimize liabilities.

- Review financial statements and records to assess tax liability.

- Identify potential deductions and credits for each client.

- Stay informed on tax law changes and their impact on clients.

- Research specific tax issues for accurate return preparation.

- Communicate with clients to answer questions and provide updates.

- Notify clients of discrepancies or additional documents needed.

- Review tax returns for accuracy and completeness before submission.

- Revise returns based on client feedback or new information.

- Organize and maintain accessible client files and documentation.

- Ensure client confidentiality at all times.

- Support clients during audits by preparing documentation and responding to tax authorities.

- Collaborate with tea

- Manage multiple client engagements efficiently.

- Identify improvements in client financial records and suggest adjustments.

Bonus Qualifications:

- Advanced Tax Knowledge or Certifications: CPA, EA, or additional U.S. tax law and compliance certifications.

- High Knowledge of various U.S. tax forms and structures (individual, entity, disregarded entity).

- Advanced organizational skills, with a proactive approach to workload and deadlines

- Experience with Excel for detailed tracking and report creation.

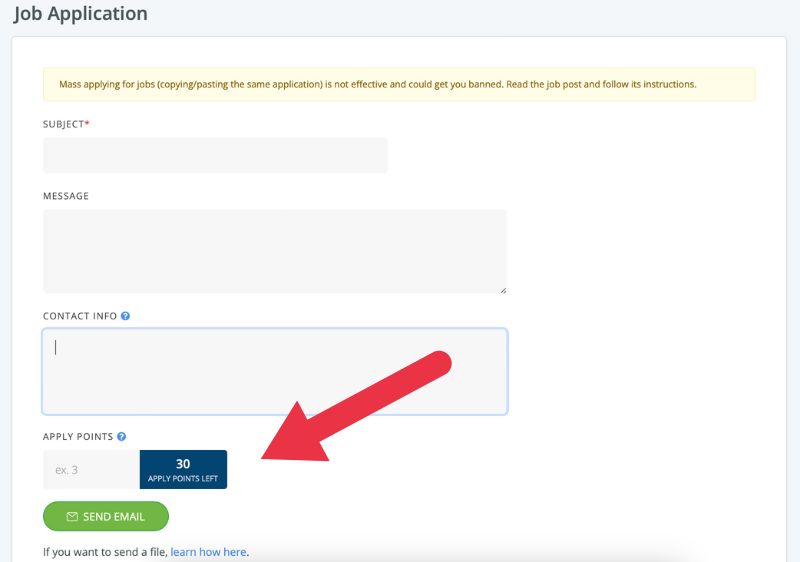

How To Apply:

Watch This Video:

Job Code: TXPKS

Link to Apply: